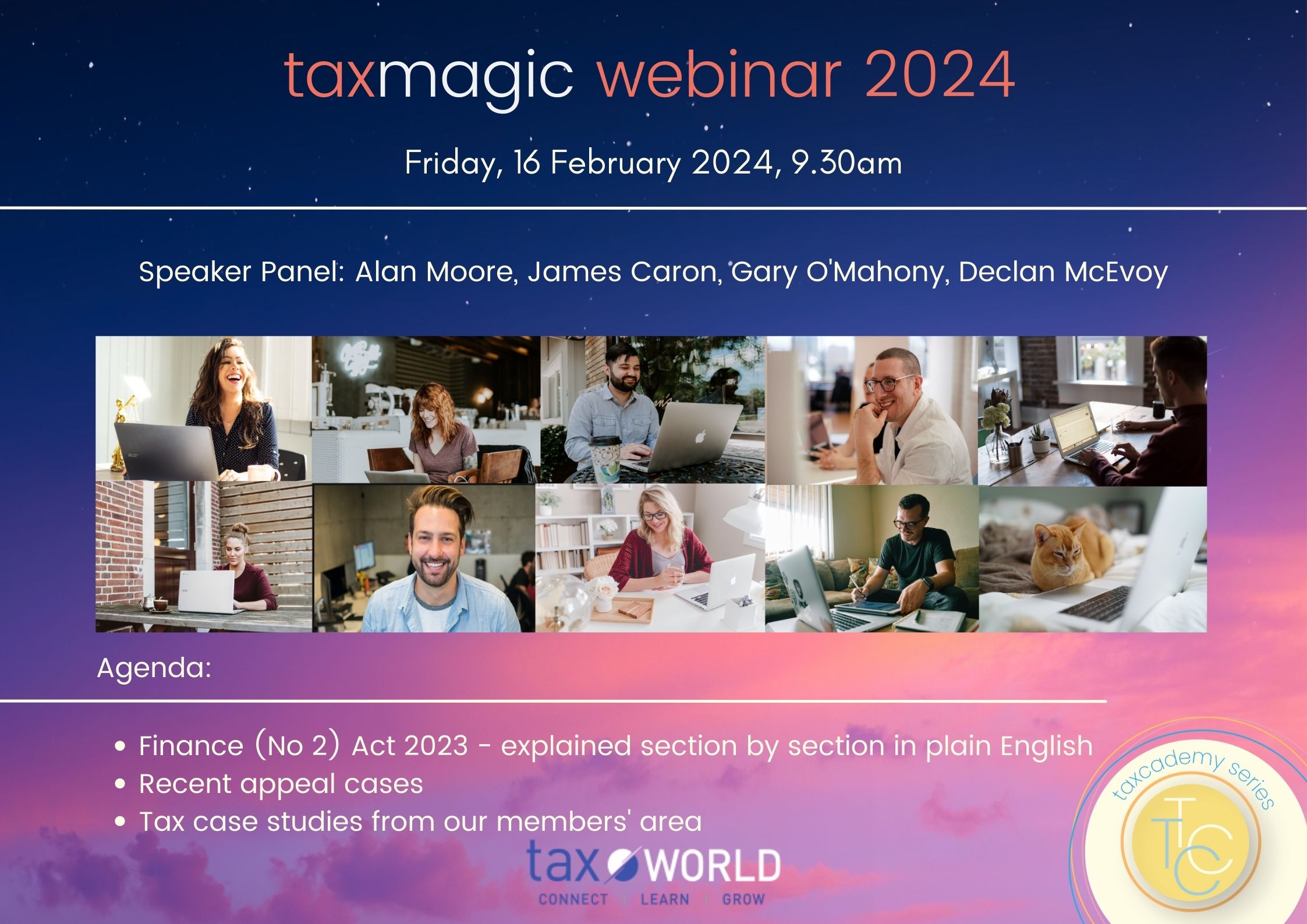

Tax Magic 2024

webinar recording

Now in its 17th year, the Tax Magic webinar is recognised as a key event in the tax calendar.

Our expert speakers will guide you through:

Finance (No 2) Act 2023 - explained section by section in plain English:

- Agricultural relief clawback

- Amateur sports bodies

- Angel investor relief

- Annual payments - 20% tax

- Anti-hybrid rules

- Bank levy

- Base erosion and profit shifting (BEPS) - Pillar two

- Benefit in kind - car

- Benefit in kind - van

- Business relief clawback

- Catch sum - four year rule

- CGT on compensation

- Charities - professional income

- Charities - Revocation of charitable status

- Clinical Placement Allowance

- Consanguinity relief

- Controlled foreign companies (CFCs)

- Defective concrete products levy

- Deposit Return Scheme

- Digital games relief

- Distributions

- Donation of heritage items

- Donations to approved bodies

- E-books, e-newspapers and audiobooks

- Electronic share transfers

- Emergency accommodation - VAT

- Employment investment incentive scheme (EIIS)

- Energy-efficient equipment

- Entrepreneur relief - subsidiaries

- Farm consolidation relief

- Farm land leasing exemption

- Farm payment entitlement

- Farm safety equipment

- Film tax credit

- Financial institution

- Financial services - VAT

- Flat-rate addition

- Foreign accounts

- Foster children - gifts and inheritances

- Four-year time limit: pay-related assessments and refunds

- Group relief

- Help to Buy - Local Authority Affordable Purchase (LAAP) scheme

- Hybrid mismatches

- Incapacitated person

- Income Inclusion Rule (IIR)

- Income tax rates, tax bands, and tax credits

- Incorrect birth registrations - gifts and inheritances

- Interest-free loans between relatives

- Landlord rental income relief

- Lease income - computation of income and expenses

- Maternity-Related Administrative Support

- Medical partnerships

- Micro-generation of electricity

- Mortgage interest tax relief

- Pre-trading expenditure

- Professional services withholding tax (PSWT)

- PRSA withdrawals

- Qualified Domestic Top-up Tax (QDTT)

- Qualifying financing companies - deductions for interest paid

- R&D tax credit

- Rent tax credit

- Rental income of pension funds

- Rents payable to non-resident

- Reporting of information - penalties

- Residential zoned land tax

- Retirement annuity contracts - approval

- Retirement relief - persons aged 55-69

- Retrofitting expenditure

- Safe Harbours

- Sea-going naval personnel credit

- Seven year CGT exemption

- Share options

- Short term lease of residential property

- Solar panels

- Stamp duty - Interest on repayment

- Stamp duty - repayments and overpayments

- Substance-Based Income Exclusion (SBIE)

- Tax havens

- Undertaxed Profit Rule (UTPR)

- Universal Social Charge

- Use of ARF assets as security

- Vacant homes tax

- VAT rates

- Vehicles for disabled persons

- Withholding tax: Interest, royalties and dividends

- Young trained farmers

- Revenue developments update

- Pensions update

- Real life case studies and recent tax appeal cases.

Q & A session with the panel - all tax topics - your chance to get answers to the questions that have been annoying you.

Speakers:

- Alan Moore from Tax World Ltd

- James Caron from Lucas Financial Consulting

- Gary O'Mahony - Managing Partner with O'Hara Dolan & Co

- Declan McEvoy - Farm Tax Adviser